city of richmond property tax 2021

Property Tax Vehicle Real Estate Tax. Other Services Adopt a pet.

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Hamilton County collects on average 153 of a propertys assessed fair market value as property tax.

. Virginia Judiciary Online Payment System VJOPS. Circuit Court Clerk for the City of Richmond VA. The exact property tax levied depends on the county in Virginia the property is located in.

Falls Church city collects the highest property tax in Virginia levying an average of 600500 094 of median home value yearly in property taxes while Buchanan County has the lowest property tax in the state collecting an average tax of 28400. Please see the Commissioners annual education tax rate letter for forecasted yields and nonhomestead rate for FY2023. The median property tax in Hamilton County Ohio is 2274 per year for a home worth the median value of 148200.

Hamilton County has one of the highest median property taxes in the United States and is ranked 332nd of the 3143 counties in order of median property taxes. The town tax rate tables and resources below are for the current 2021-2022 property tax year FY2022.

Virginia Property Tax Calculator Smartasset

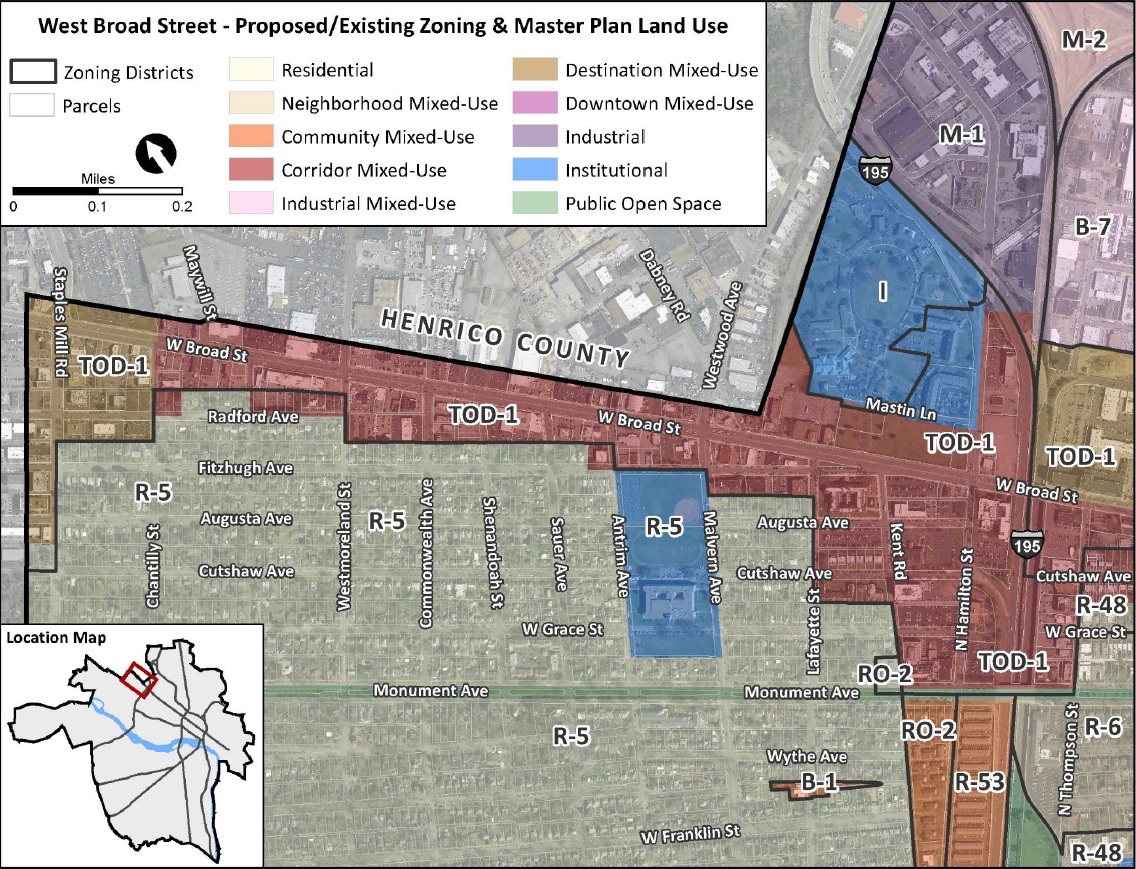

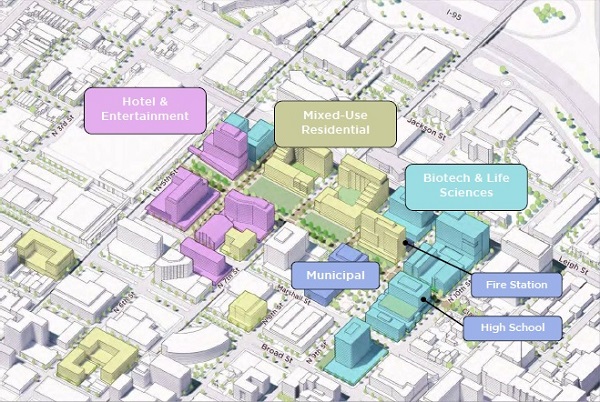

City Ponders Plan To Extend Tod Zoning Westward Along Broad Street Richmond Bizsense

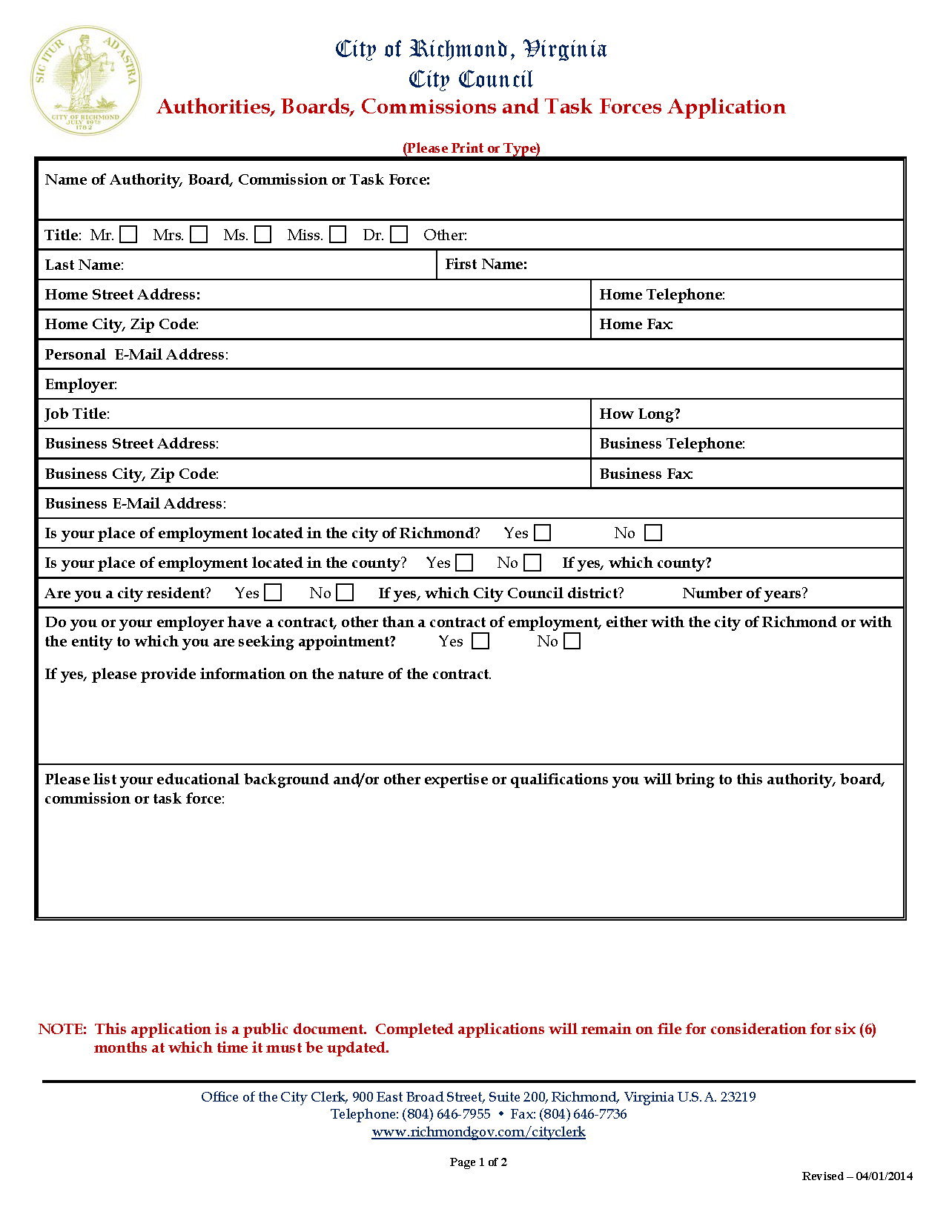

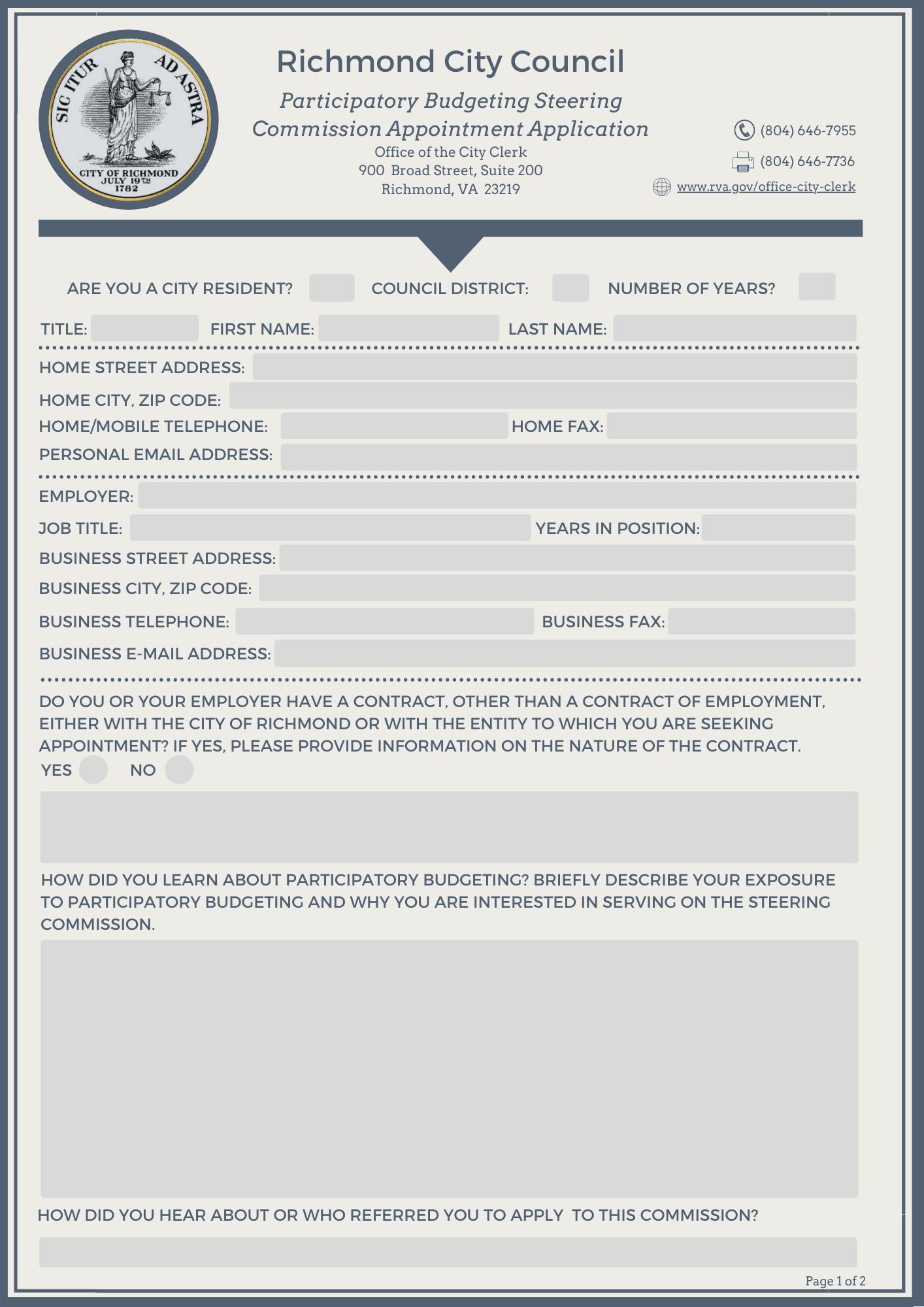

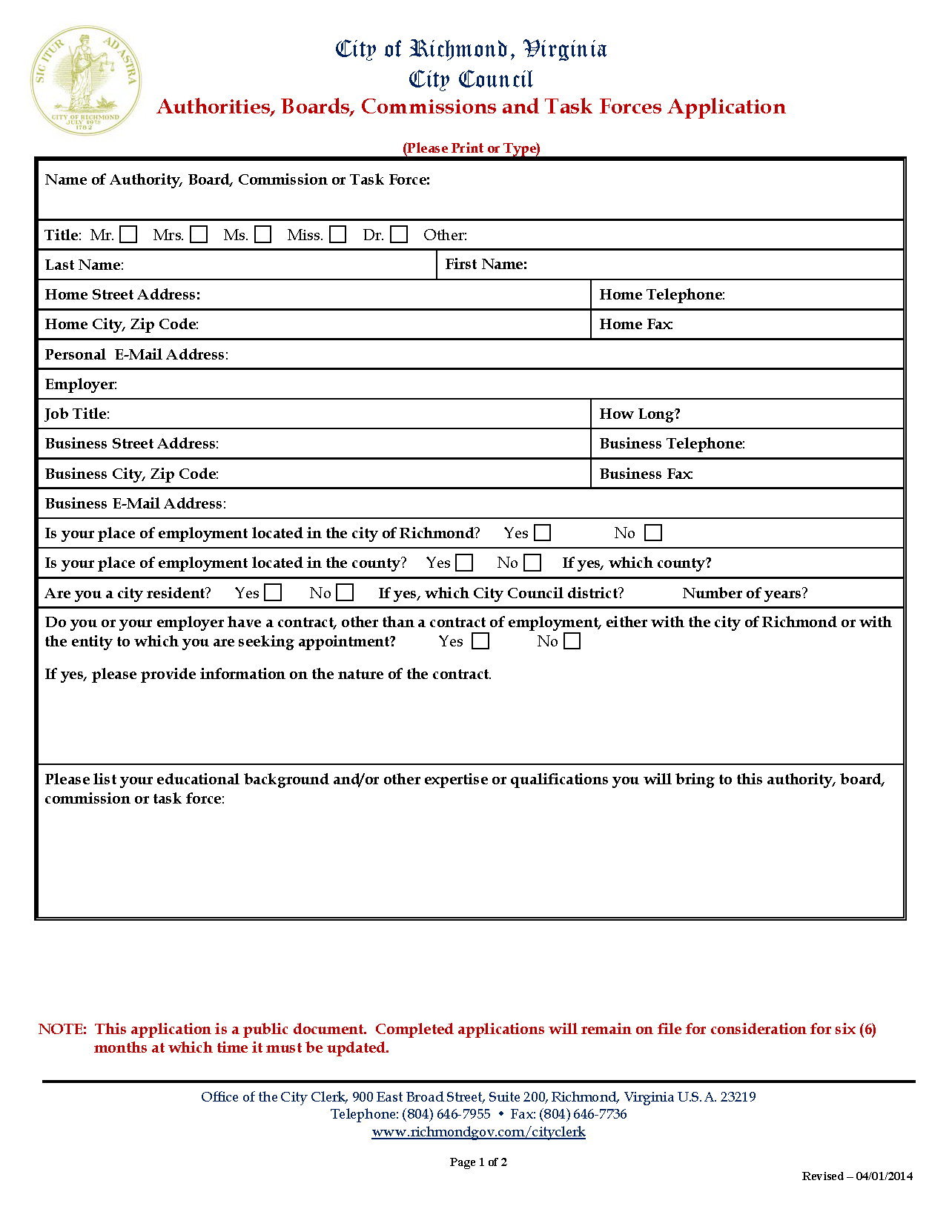

Boards And Commissions Richmond

Boards And Commissions Richmond

City S New City Center Plan Envisions Downtown Without The Coliseum Richmond Bizsense